Navigating the simultaneous process of selling your current home and buying a new one can be complex and stressful. However, careful planning and strategic timing can streamline the process and minimize potential headaches. Here are some essential tips to help you smoothly align selling your home and purchasing a new one.

- Understand the Market Conditions

Before diving into the selling and buying process, it’s crucial to understand the current real estate market conditions. Are you in a buyer’s market, where more homes are available than buyers? Or is it a seller’s market, where buyers compete for fewer properties? Knowing this can help you set realistic expectations for selling your home and purchasing a new one.

In a seller’s market, you may sell your home quickly but face stiff competition when buying. Conversely, a purchaser’s new home might be easier in a buyer’s market, but selling your current one could take longer.

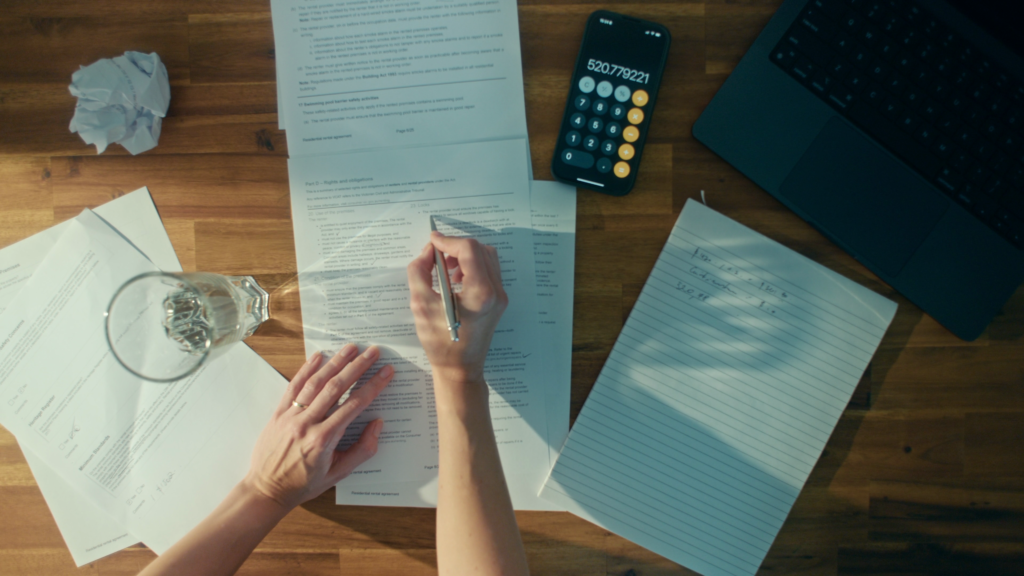

- Get Your Finances in Order

Aligning the sale of your current home with purchasing a new one requires financial readiness. Start by getting a clear understanding of your financial situation:

- Get Pre-Approved for a Mortgage: Before you start house hunting, secure a mortgage pre-approval. This gives you a clear picture of how much you can afford and shows sellers that you are a serious buyer.

- Estimate Your Home’s Value: Work with a real estate agent to determine your home’s market value. This will help you understand how much equity you must pay for your new home.

- Budget for Overlapping Costs: Be prepared for potential overlapping costs, such as temporary housing, storage, or dual mortgage payments.

- Choose the Right Real Estate Agent

A skilled real estate agent can be invaluable in coordinating the sale and purchase process. Choose an agent with experience with simultaneous transactions and can offer strategic advice tailored to your situation. Your agent will help you price your home competitively, market it effectively, and negotiate favorable terms on both sides of the transaction.

- Synchronize Closing Dates

One of the trickiest aspects of selling and buying simultaneously is aligning the closing dates. Ideally, you want the sale of your current home and the purchase of your new home to close on the same day or within a few days. This minimizes the period when you might be without a home or have to manage two properties.

Consider including contingency clauses in your contracts, such as a home sale contingency, which allows you to cancel the purchase if your current home doesn’t sell by a specific date. This can provide some financial protection and flexibility.

- Plan for Temporary Housing

Despite your best efforts, a gap may exist between selling your home and moving into your new one. Having a plan for temporary housing can alleviate stress if things don’t align perfectly. Options include:

- Short-Term Rentals: Rent an apartment or house on a month-to-month basis.

- Stay with Family or Friends: Stay with loved ones temporarily to save on costs.

- Extended-Stay Hotels: These can be more comfortable than standard hotels and often have amenities like kitchens.

- Coordinate Moving Logistics

Efficient moving logistics are essential for a smooth transition. Hire a reputable moving company and schedule your move well in advance. If there’s a gap between your move-out and move-in dates, consider using a moving company that offers storage solutions.

- Stay Organized and Communicate

It is crucial to stay organized and maintain clear communication with all parties involved—real estate agents, lenders, buyers, and sellers. Keep detailed records of all transactions and correspondence, and do not hesitate to ask questions or seek clarification when needed.

Final Thoughts

Aligning the sale of your current home with purchasing a new one requires careful planning, strategic timing, and flexibility. By understanding the market, getting your finances in order, choosing the right real estate agent, and staying organized, you can navigate this complex process with confidence and ease. With the right approach, you’ll be well on your way to successfully transitioning from one home to the next.