Determining the right amount can be challenging when you’re ready to make an offer on a house. Offering too low may result in losing the home while providing too high can lead to overpaying. Here’s a guide to help you decide how much to offer, including a reasonable offer chart for different scenarios.

Factors to Consider When Making an Offer

1. Market Conditions:

- Buyer’s Market: More homes are available than buyers, giving you more negotiating power. You can start with a lower offer.

- Seller’s Market: There are more buyers than homes, making competition stiff. Offers close to or above the asking price are common.

2. Comparative Market Analysis (CMA):

- Your real estate agent can provide a CMA, which compares the property to similar homes sold recently in the area. This helps you understand the market value.

3. Property Condition:

- Consider the age, condition, and any needed repairs or upgrades. A home requiring significant work might warrant a lower offer.

4. Days on Market (DOM):

- For a long time, a property on the Market might indicate overpricing or a lack of interest, suggesting room for negotiation.

5. Seller’s Motivation:

- If the seller is in a hurry to move due to a job relocation, financial issues, or other reasons, they might be more willing to accept a lower offer.

6. Appraisal Value:

- Ensure your offer aligns with the home’s appraised value, especially if you’re financing the purchase. Lenders may only approve loans for amounts within the appraisal.

7. Your Budget:

- Stick to what you can afford. Consider additional costs like closing fees, repairs, and moving expenses.

How to Structure Your Offer

1. Start with a Strong Initial Offer:

- Make a fair offer based on the CMA and other factors. Starting too low can offend sellers, while a reasonable offer shows you’re serious.

2. Include Contingencies:

- Typical contingencies include financing, appraisal, and home inspection. These protect you in case something goes wrong.

3. Offer Earnest Money:

- A higher earnest money deposit shows good faith and can make your offer more attractive.

4. Be Flexible with Closing Dates:

- Accommodating the seller’s preferred timeline can make your offer stand out.

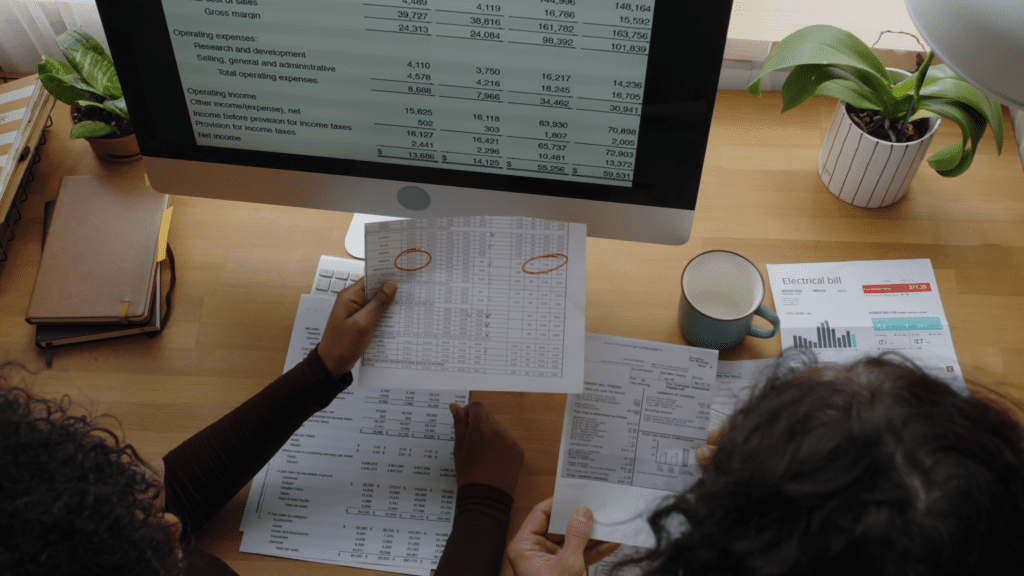

Reasonable Offer Chart

This chart provides a rough guide for offers based on market conditions and other factors. Adjust according to specific circumstances and advice from your real estate agent.

Market ConditionAsking PriceSuggested Offer (% of Asking Price)

Buyer’s Market $300,000 90% – 95% ($270,000 – $285,000)

Balanced Market $300,000 95% – 100% ($285,000 – $300,000)

Seller’s Market $300,000 100% – 105% ($300,000 – $315,000)

Additional Considerations:

- Property Condition:

- Excellent Condition: +2-3% to suggested offer

- Needs Minor Repairs: -1-2% to suggested offer

- Needs Major Repairs: -3-5% to suggested offer

- Days on Market:

- <30 Days: Stick closer to the asking price

- 30-60 Days: 1-2% below asking price

- 60 Days: 3-5% below asking price

Conclusion

Determining how much to offer on a house requires careful consideration of various factors. You can make a well-informed offer by understanding the market conditions, evaluating the property, and considering your budget. Use the reasonable offer chart as a starting point, but consult your real estate agent to tailor your offer to the specific situation. With a strategic approach, you can increase your chances of securing your dream home at a fair price.