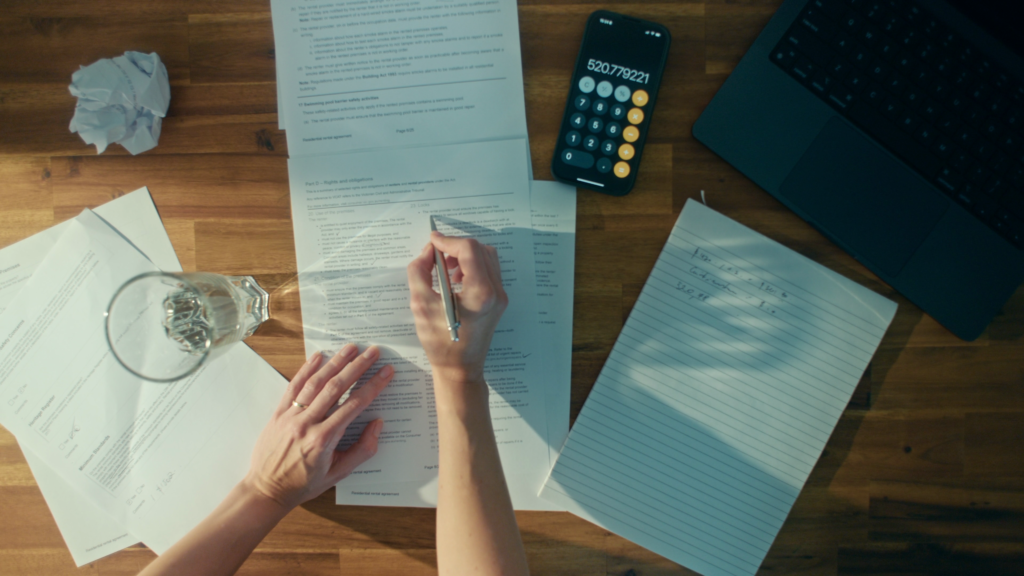

Deciding when to buy a home is one of your most significant financial decisions. The real estate market is influenced by numerous factors, making it crucial to assess whether it’s the right time for you to make such an investment. In this pocket guide, we’ll explore the key considerations to help you determine when to buy a home.

Assess Your Financial Situation

Before diving into the housing market, evaluating your financial health is essential. Consider the following:

- Savings and Down Payment: Do you have enough savings for a down payment? A larger down payment can reduce monthly mortgage payments and eliminate the need for private mortgage insurance (PMI).

- Credit Score: A good credit score can help you secure a lower mortgage interest rate, saving you thousands of dollars over the life of the loan.

- Debt-to-income Ratio: Lenders typically prefer a debt-to-income ratio below 43%. Calculate your ratio to see if it meets this criterion.

- Emergency Fund: Ensure you have an emergency fund that covers at least 3-6 months of living expenses to handle unexpected costs.

Understand the Current Market Conditions

The state of the housing market can significantly impact your decision to buy. Pay attention to these factors:

- Interest Rates: Mortgage interest rates fluctuate based on economic conditions. Lower rates can make homeownership more affordable, while higher rates can increase your monthly payments.

- Home Prices: Research current home prices in your desired area. Are prices rising, stable, or declining? Rising prices indicate a seller’s market, while stable or declining prices offer more opportunities for buyers.

- Inventory Levels: High inventory levels typically lead to more choices and potentially lower prices for buyers. Conversely, low inventory can drive up competition and prices.

- Economic Indicators: Look at broader economic indicators such as employment rates and consumer confidence. A strong economy can support a healthy housing market.

Consider Your Long-Term Plans

Buying a home is a long-term commitment. Reflect on your plans:

- Stability: Are you planning to stay in the exact location for at least 5-7 years? Buying a home can be more cost-effective than renting if you plan to stay put longer.

- Family and Lifestyle Changes: Consider any upcoming changes, such as marriage, children, or career moves, which might affect your housing needs.

Evaluate Rent vs. Buy

Sometimes, renting might be more advantageous than buying, depending on your circumstances:

- Cost Comparison: Compare the cost of renting versus buying in your area. Factor in all expenses, including maintenance, property taxes, and insurance.

- Flexibility: Renting offers greater flexibility if you need clarity about your long-term plans or job stability.

- Investment: While buying a home can be a good investment, it’s essential to consider whether you’re ready for the responsibilities and costs associated with homeownership.

Seek Professional Advice

Consulting with real estate professionals, such as agents and financial advisors, can provide valuable insights tailored to your situation. They can help you navigate the complexities of the housing market and make an informed decision.

Conclusion

Deciding whether now is the right time to buy a home involves careful consideration of your financial situation, market conditions, long-term plans, and the advantages of renting versus buying. By thoroughly evaluating these factors, you can make a well-informed decision that aligns with your goals and financial stability. Remember, buying a home is a significant commitment, and assessing your readiness can lead to a more satisfying and secure homeownership experience.